payday loans com

Tips Pay money for A lease That have A personal bank loan

It will affect some one. You’d to repair the car, otherwise someone took your wallet, or if you did not rating as numerous circumstances as you called for from the performs now their book is due and you also don’t have it. Even though you can be persuade your own landlord to allow you to spend a couple of weeks later, what will you do the following month? A consumer loan to blow rent can acquire your specific breathing room.

What takes place if you don’t pay rent emergency loans with no credit check?

If you’re unable to pay the lease, the effects is major, dependent on your geographical area. No less than, it is possible to incur a belated fee (essentially 5% of rent due) and perhaps an extra percentage when you’re most late (doing ten% of one’s lease owed).

Your own rental background may become part of your credit report in the event the your own property owner spends an assistance so you’re able to declaration costs. Or, for folks who connect with get or book a property throughout the upcoming, late book may cause the application to be declined.

You are evicted if you don’t spend your own rent. In a number of areas, a landlord normally boot your away with around three days’ observe. While you get off while you are due earlier-owed book, brand new property manager may sue both you and receive a wisdom. Judgments try public records and certainly will perform many ruin towards credit history.

Dos and you can don’ts when you are small toward book

Knowing you simply will not have the ability to pay your own lease entirely and on big date, face the challenge at once.

- Do inform your property manager in writing if you’d like a number of a lot more weeks to come up with their book.

- Do not say-nothing and hope the property owner won’t notice the destroyed fee.

- Carry out explain the character of your own problem, and if you expect to solve it.

- Never go empty-handed. A partial fee is superior to no payment after all.

- Manage vow on paper to pay the full matter by the a specific big date and sustain which promise.

- Cannot bring nothing but poor reasons.

- Would apologize into the later fee and you may pledge to invest towards time in the future.

- Cannot develop a be sure you simply cannot safety. The new charges and stress might possibly be a lot higher.

Their landlord will probably costs a belated fee. Never fight over it. But not, if for example the connection with the property owner excellent and you have never been later ahead of, you could inquire about a fee waiver. Particularly if you pay about the main book to the big date.

Pay rent having a consumer loan

The new methods mentioned above might be tough to over. How do you guarantee not to ever skip a lease commission again? Whenever right after paying their month’s lease (late) you are going to need to put together second month’s rent straight away? How will you get free from one duration of being bankrupt into the to begin this new month? By getting some cash you don’t have to pay-off into the full ab muscles the following month.

A consumer loan to invest book can provide you with 1 year or expanded to catch up on the rent fee. For people who skipped a beneficial $1,000 lease fee, you don’t have to come up with $dos,100 next month. Rather, you could slowly spend that $1,100000 over time.

For many who pay rent with an unsecured loan, you could replace your credit rating. A cost loan with a good cost records is pleasing to the eye on the your credit report. In addition to this, after you pay your loan out of, remain sending you to definitely same monthly number each month on the own coupons. So that the the next time you have got an economic disaster, you’ll have money to pay for they.

How come a consumer loan for rent work?

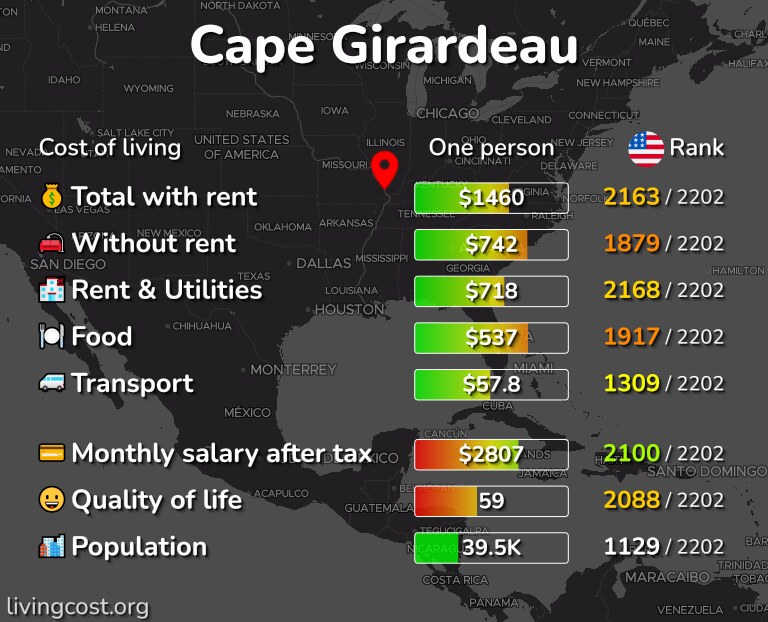

You can find unsecured loans during the wide variety of $step one,000 to $a hundred,000. Their attention rates cover anything from six% and you will 36% for the majority of popular lenders. If you’re loan terms and conditions might be up to ten years, you need to be in a position to security a lease loan into the several days otherwise a lot fewer. This new chart less than suggests the amount borrowed and you may interest rate impact the commission more a single-seasons term.

Fee because of the Loan amount and you can Rate of interest

You will find personal bank loan also provides on this website. Choose the give that ideal meets your needs. Information about how signature loans really works:

- He is unsecured, you cannot build an asset such as an automobile otherwise household.

Other ways to use your personal loan

Needless to say, you don’t want to acquire more you desire otherwise can be repay since conformed. But when you remove a personal loan for rental, you are in a position to solve another disease by borrowing good nothing most.

In the event your credit card debt is just too highest, instance, you could obvious it with a consumer loan. Consumer loan rates are below bank card attract prices. And you can substitution credit debt having an installment financing is boost your credit rating. An additional benefit is the fact with a personal loan, there is a conclusion coming soon to suit your credit debt. And then make minimal percentage on your plastic material almost pledges one you’ll end up indebted forever.

Another a fool around with to have a personal bank loan is to try to do an enthusiastic emergency loans. So if things unanticipated appears, you can defense they whilst still being pay the rent punctually. Should your rent is $step one,one hundred thousand, you could acquire $2,100000 and put the additional to the an urgent situation checking account. It’s here if you’d like it. Pay the loan off inside a year. If in case you really have had no problems, you’ll have $step one,one hundred thousand in offers.

After you pay-off the personal loan, continue steadily to reserved this new payment count. However, this time, add it to their family savings. Just in case you are going various other year rather than emergencies, you will have more $3,100000 in the offers.

In place of are swept up when you look at the a routine regarding paying late and getting bankrupt, you’ll be on your journey to economic safety. And that have good credit. And you will and also make the landlord happy, or perhaps also buying your own home.