paydayloanalabama.com+loachapoka cash to go and advance america

Where to find the best Home loan Rates

Latest Prices

.png?format=1500w)

Check out today’s lower costs! To find out more, contact us at 800-353-4449 or initiate your application on the internet now.

*Adjustable Price Mortgages is adjustable, along with your Apr (APR) get improve following the modern fixed-rates months. The first Adjusted Payments presented are based on the modern Ongoing Readiness Treasury (CMT) directory, and also the margin (totally noted speed) given that said energetic big date round toward nearby step one/8th of a single percent. Have a look at facts right here.

*Changeable Price Mortgage loans is changeable, and your Annual percentage rate (APR) may boost following the completely new repaired-rates period. The first Modified Payments shown are based on the current Lingering Readiness Treasury (CMT) index, and also the margin (totally listed speed) due to the fact stated energetic time round for the nearby step 1/8th of a single %. Take a look at info right here.

*Adjustable Rate Mortgages try adjustable, as well as your Apr (APR) get increase pursuing the new repaired-rate period. The first Modified Repayments shown derive from the modern Ongoing Maturity Treasury (CMT) directory, as well as the margin (fully listed speed) due to the fact mentioned effective date round for the nearest step 1/8th of just one per cent. Check additional info here.

What provided assumes on the intention of the mortgage would be to pick a current unmarried loved ones isolated household and will also be utilized due to the fact an excellent priount is actually $150,100 together with price is $2 hundred,100. Having Golden Jumbos, the loan amount try $647,two hundred and also the appraised worthy of try $625,100. To have FHA Financing, the loan count try $150,100 and the appraised worth is $152,850. The home is found in Oakland State, Michigan. There clearly was an enthusiastic escrow account fully for property taxes and you will home insurance. The interest rate lock months is 45 weeks while the thought borrowing score is actually 740 or even more.

The fresh new monthly payment matter revealed is sold with simply dominant and you may attract. Brand new escrow to possess possessions fees, homeowners insurance, ton and you can/otherwise mortgage insurance rates if the appropriate aren’t within the monthly payment number. Your real monthly payment would be highest having escrow payday loan Loachapoka account integrated.

The attention pricing, APRs and you will things shown may changes for hours due to differing . Prices is susceptible to changes. For much more specific and you may personalized efficiency, delight label 800-353-4449 to speak with financing expert.

The borrowed funds Procedure

Protecting a home loan are a critical action for the gaining the homeownership desires. If you find yourself considering buying a home, learn more about the loan process to help you to get been.

What is actually a mortgage?

A mortgage is a type of mortgage accustomed pick a house. Its a contract between your, the latest debtor, and you may a mortgage lender to purchase property without having to pay the the bucks initial. Instead, you pay the financial institution over the years due to a number of typical money.

Why does home financing Work?

When you get home financing, a lender offers a certain amount of currency to shop for a home. You have to pay right back so it count (referred to as dominant) which have desire more than an agreed-upon period. As soon as your financial was paid down, you have complete ownership of the house. Remember that if you don’t shell out your home loan, the financial normally foreclose your house.

Form of Mortgage loans

You can select various kinds of mortgage loans to match their certain requires. Every type includes more conditions and you will benefits. Some traditional particular mortgage loans become:

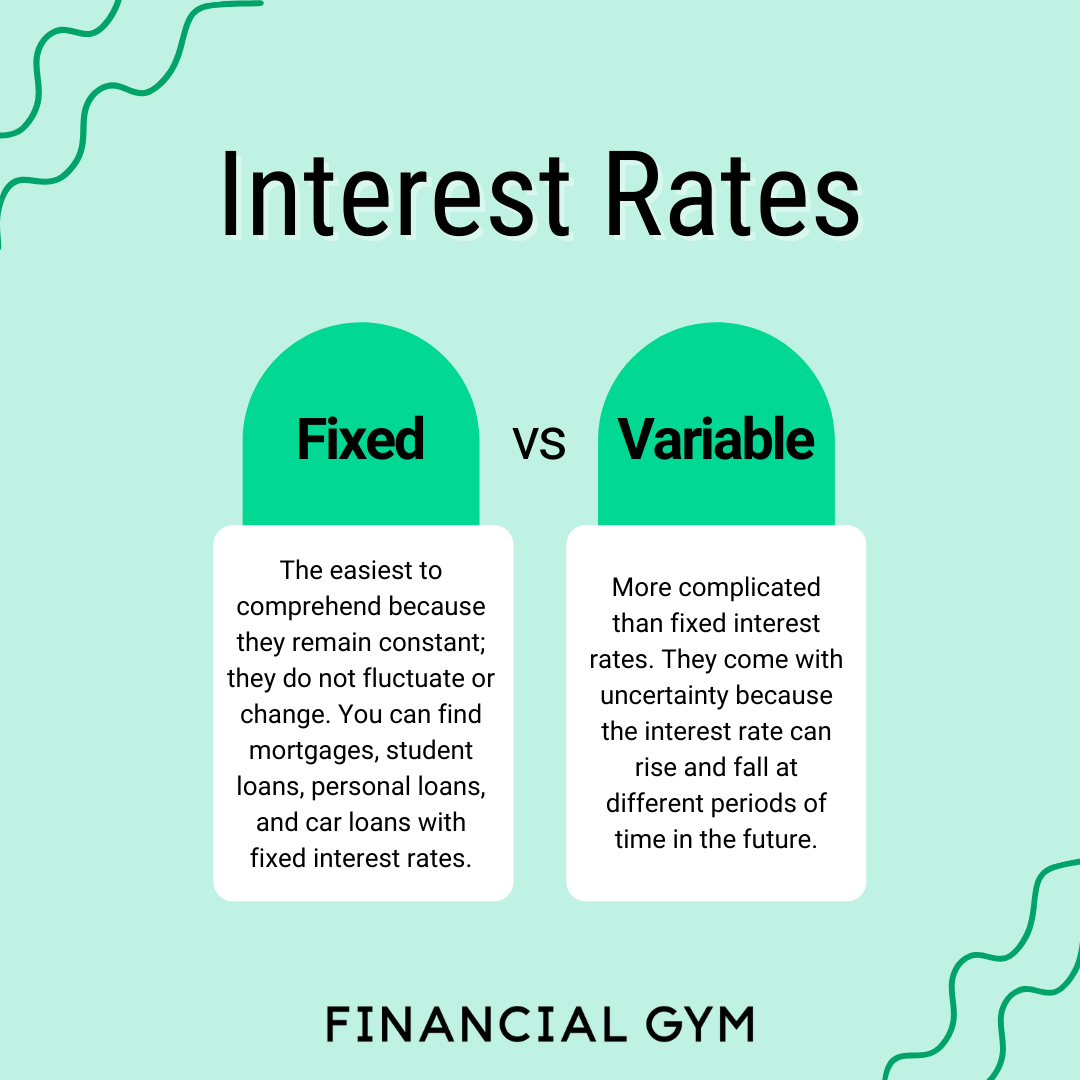

- Fixed-Rate Mortgages: Fixed-rate mortgages – labeled as conventional otherwise traditional mortgages – have an interest rate that does not alter for your length of your home loan. Antique mortgage words can be as much time because forty years and you will just like the brief while the five years. Widely known sizes was fifteen and you can 30-seasons fixed-rate mortgages.

- Adjustable-Price Mortgage loans (ARMs): Adjustable-price mortgages have an interest speed one alter on market immediately after a primary fixed several months. Arms are typically 31-seasons financing having an effective 5, 7, or ten-season fixed months.

- Government-Backed Mortgages: Government-recognized mortgages is actually insured because of the a federal government department. Widely known items was Government Casing Management (FHA), Department regarding Veteran Issues (VA) and you can All of us Company out-of Farming (USDA) finance. For each and every have specific eligibility requirements and you will is sold with book experts you won’t score from other sorts of mortgages.

Additional loan providers give some mortgage pricing in line with the kind of mortgage plus official certification. After you make an application for a home loan, the lending company often opinion economic and personal details just like your borrowing from the bank rating, debt-to-income proportion and you can work history to determine the qualification and you may rates. With a good credit score and and make extreme down payment helps you keep the greatest mortgage rate.

With quite a few mortgage products and prices available, looking around is essential to locating a knowledgeable rates. Use the tables below examine our home loan costs for other lenders.

Dependence on Locating the best Mortgage lender

Selecting the most appropriate mortgage lender is a crucial part of your homebuying processes. Actually moderate differences in lender pricing and you will charges tends to make a big difference over the years. You additionally need to make sure you decide on a reputable company that you feel safe coping with.

Because you shop for the right lender, take into account the advantages of working with Financial Cardiovascular system. We have been a prominent lending company in the Midwest for over thirty years. We offer reduced rates and you can individualized provider to create the homebuying dreams a reality.