clickcashadvance.com+payday-loans-co+portland bad credit loans no payday

Can be Your credit score Feeling Your loan App?

- Personal Financing

- Checked

How much does your credit rating say in regards to you? This can be a significant matter to inquire of, since if you are searching so you’re able to borrow cash, your credit score may have a life threatening affect your loan app.

If you were economically influenced by the fresh new COVID-19 break out while having paused costs into a specific loan, you may also become wanting to know often which perception my personal credit score?. Why don’t we take a closer look.

Why does your credit rating number?

Your credit rating could be reported to be a dimension out-of just how dependable youre viewed to be once the a debtor. It is one of many important aspects lenders consider whenever choosing whether or not to provide your currency.

As a general rule, the greater your rating, the greater appealing you’re given that a buyers once you make an application for products like playing cards, personal loans, mortgage brokers, cellphone arrangements or perhaps in-shop resource. It may plus make available to you much more favourable credit terminology to have money. Particularly, you may find you have got significantly more capacity to negotiate a better interest on your loan, or potentially even improved borrowing capability.

A lower get you will suggest the loan software program is rejected, or the credit terms and conditions you might be given can be shorter favorable, for example being charged higher appeal.

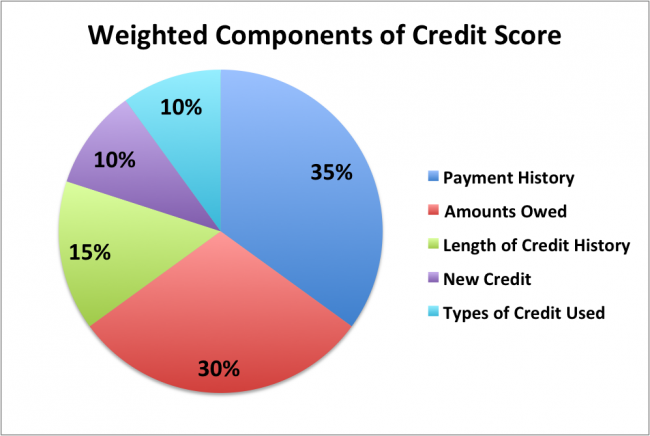

Exactly what products dictate a or bad credit score?

Within the , Australia gone entirely in order to a comprehensive Credit scoring (CCR) system, hence necessitates the addition off self-confident borrowing from the bank recommendations getting a more balanced investigations off applicants’ borrowing records. Your credit score today takes into account one another positive and you may poor economic models.

- an ability to consistently pay the bills on time (age.g. cellular phone agreements, internet sites and you will tools)

- a professional installment record into any credit circumstances you in the past taken aside

- evidence of normal savings craft (age.g. depositing $20 towards the a savings account weekly)

- an everyday and you can reputable money

- a history of purchasing more minimal https://clickcashadvance.com/payday-loans-co/portland/ monthly payment for mastercard money

- a track record of unsuccessful credit applications

- defaults for the expense otherwise costs

Usually applying for financing cost pause through the COVID-19 impression your credit score?

To support Australians against pecuniary hardship because of the COVID-19 outbreak, of numerous banking institutions provides considering doing a half dozen-week pause toward mortgage payments having eligible customers.

Typically one skipped mortgage costs (over 2 weeks later) might be filed in the a customer’s credit report and you may remaining for couple of years included in its payment records information, according to CreditSmart.

But not, the latest Australian Banking Association (ABA) keeps revealed why these suggestions wouldn’t be kept to possess people who had been considering acceptance so you’re able to stop its loan money owed so you can COVID-19, provided they certainly were up to date with their costs when supplied recovery.

If you were behind inside the loan money before you can was basically granted an excellent deferral, banking institutions will determine how to declaration the individuals skipped costs just like the deferral months comes to an end, in the fresh meantime will not file a research.

It is important to note that if you have not provided an arrangement along with your lender to put off your repayments in this drama, upcoming any missed or later repayments you will do make may getting recorded in your credit report. As a result, if you are searching in order to pause your loan payments you will want to think contacting your own financial as soon as possible to see if you are eligible.

Exactly what credit score should you aim for?

In australia, your credit rating will generally feel approximately 0 and you can sometimes step 1,000 otherwise step one,two hundred, with respect to the credit scoring department make use of. Credit scores will normally be build with the four additional groups. Using borrowing agencies Equifax including, this may appear to be which: